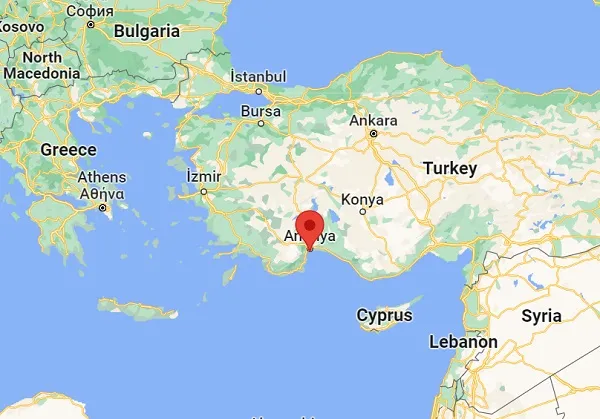

If you’re looking to invest in the Turkish Riviera without breaking the bank, both Antalya and Alanya offer compelling destinations — especially in areas that have transformed remarkably in recent years.

From Quiet Villages to Affordable Havens

Areas like Kepez in Antalya once lay in the shadow of coastal glamour, lacking infrastructure and international buzz. Rapid development turned it into a budget-friendly magnet with growing amenities. Similarly, Mahmutlar (east of Alanya) used to be a sleepy settlement but has been reshaped by holiday apartments and improved roads to serve European tourism. In Alanya, places like Oba, Avsallar, Konaklı, and Yeşilöz each tell a similar story: quiet beginnings and centuries-old roots transformed by tourism and strategic location.

More off-the-beaten-path spots such as Yeşilöz remain relatively affordable—blending serene coastal charm with future potential, especially with planned developments like golf courses and proximity to Gazipaşa Airport.

A Brief History of Antalya–Alanya Real Estate

The last decade witnessed dramatic national price surges. Between 2020–2022, new-build prices soared 70–141% annually, and resale prices surged even more—up to 154% in 2022. In 2025, prices still climbed about 30–34% YoY, though real-term growth adjusted for inflation is negative.

Local hotspots like Lara, Konyaaltı, and Belek have seen consistent interest. Kepez, once considered modest, is now one of the fastest-growing value zones.

Why 2025 Is a Strategic Time to Invest

1. Upward Price Momentum with Real Potential

Real-term price gains may be flat or slightly negative, but nominal prices are still rising at 30–34% annually. Forecasts for Antalya predict steady growth of 5–10% through 2025 and beyond, driven by tourism and infrastructure expansion like high-speed train projects.

2. Tourism Demand Fuels Rental Income

Antalya welcomed nearly 17.3 million visitors in 2024—an 8% increase from the previous year. Coastal areas like Konyaaltı and Lara remain in high demand for short-term rentals, delivering around 15% ROI. Turkey’s overall tourism revenue reached a record $61.1 billion in 2024, underscoring the region’s growing appeal.

3. Aging Population Boosts Retirement-Oriented Demand

By 2023, Turkey’s population aged 65+ reached over 8.7 million (10.2%), projected to rise to 12.9% by 2030. Antalya is becoming a top destination for retirees, increasing demand for accessible housing and retirement communities.

4. Strategic Infrastructure Enhances Future Upside

Investments like high-speed rail, improved transit infrastructure, coastal development, and international airports promise to elevate local property values steadily.

Investment Snapshot: Affordable Spots to Watch

| Area | Why It’s Affordable & Promising |

|---|---|

| Kepez | Transitioning from budget zone to growth hotspot in Antalya. |

| Mahmutlar | Evolved from rural to tourist-ready — great access & value. |

| Oba / Avsallar / Konaklı | Coastal access with moderate prices, infrastructure improves. |

| Yeşilöz | Low-density charm, future-focused, capped development. |

Final Thoughts

The Riviera’s real estate market is maturing—while overall price growth is stabilizing, demand continues to rise via tourism, domestic buyers, and retiree-driven housing needs. Affordable neighborhoods near the coast are becoming strategic plays for long-term value and rental potential. With support from infrastructure upgrades, Turkey-wide economic trends, and demographic shifts, 2025 presents a unique window to enter the market.

English

English